how to pay late excise tax online

EXCISE TAX LATE PAYMENT NOTICE. Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089.

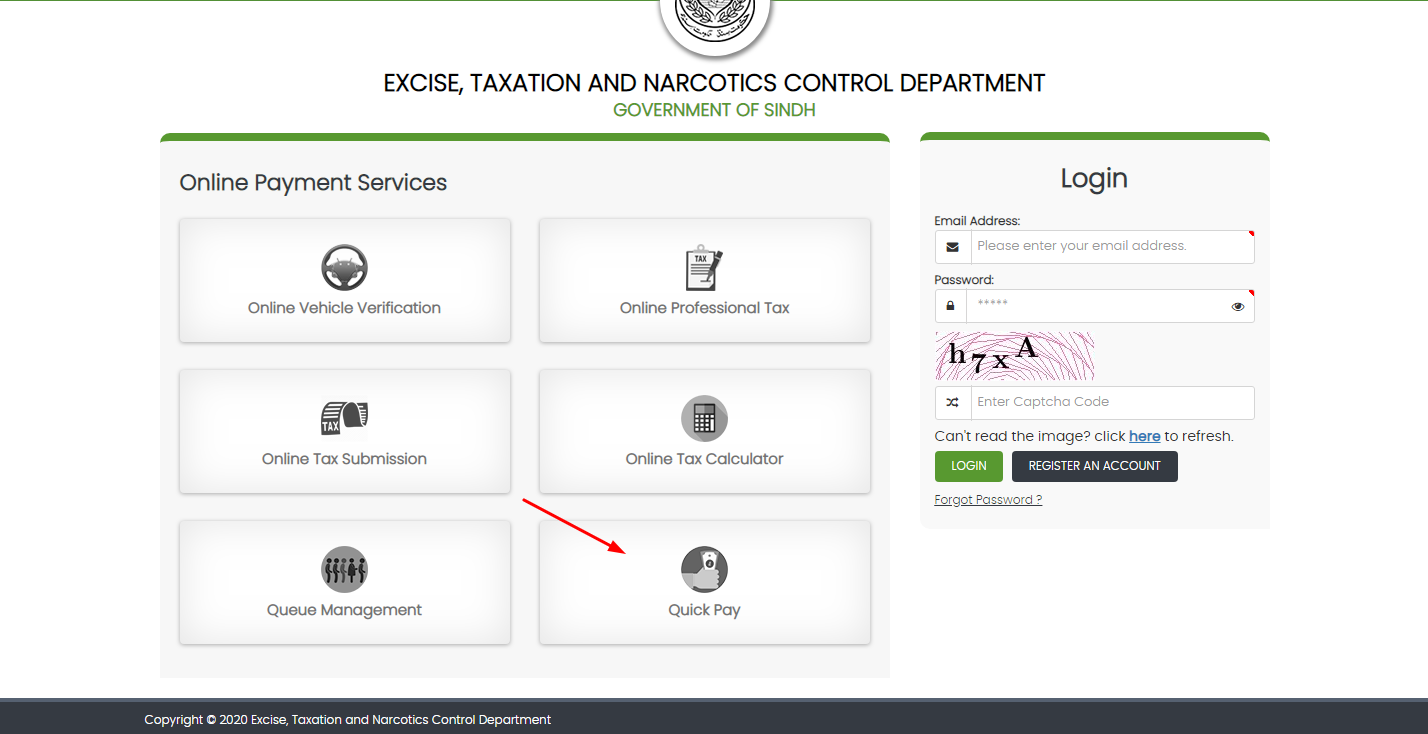

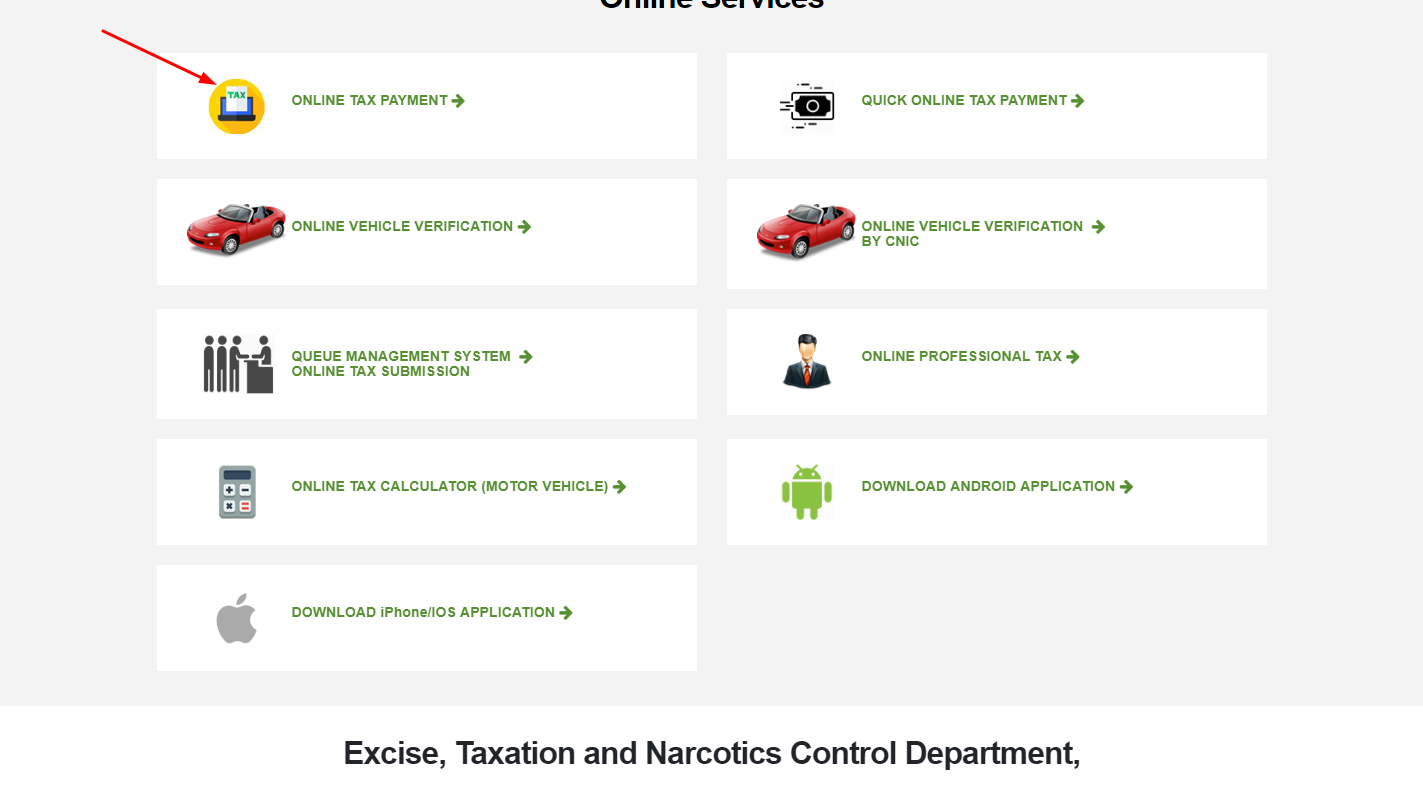

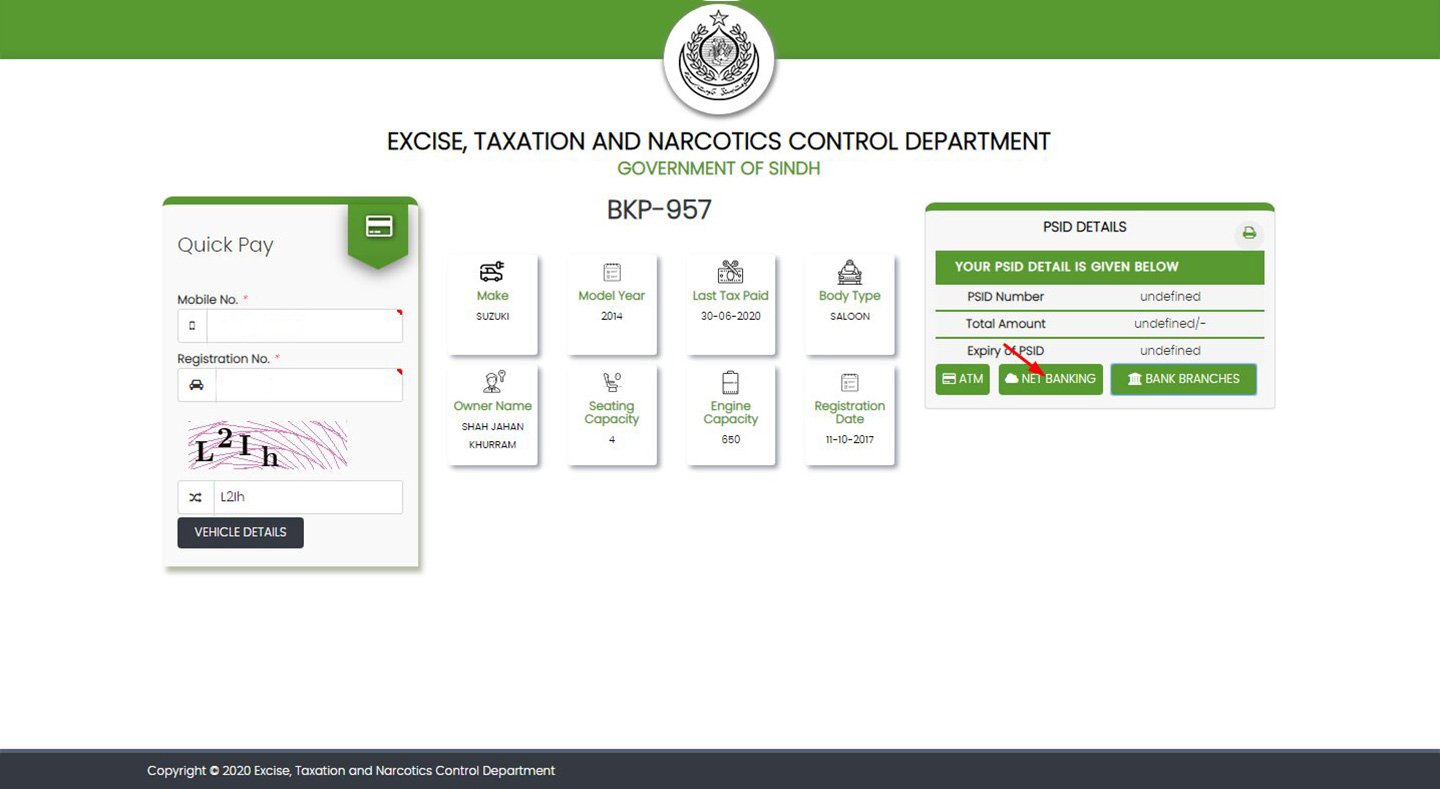

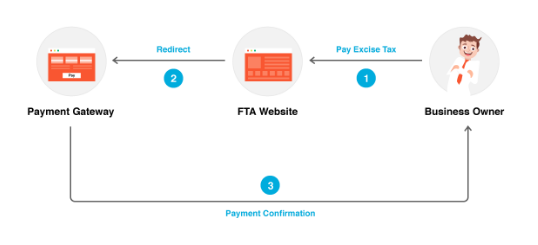

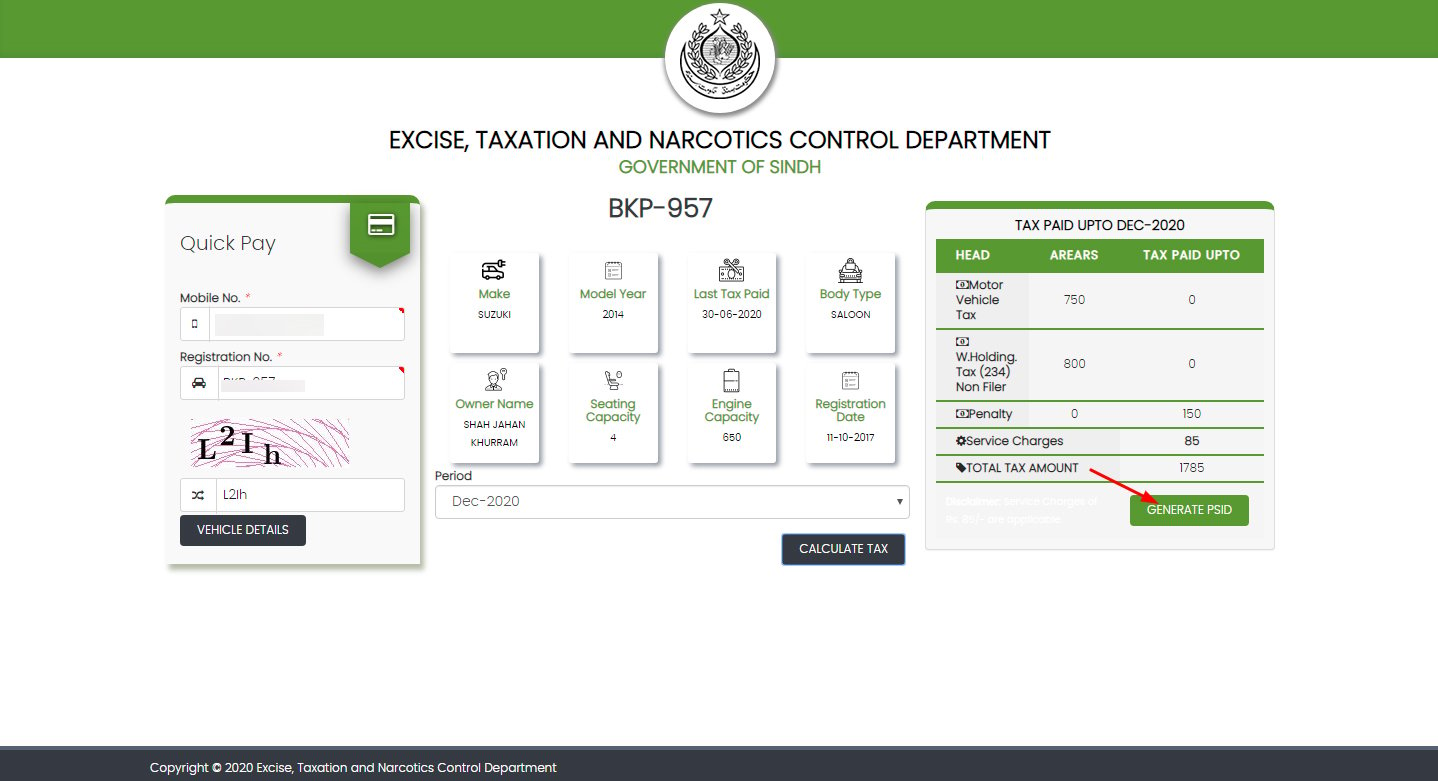

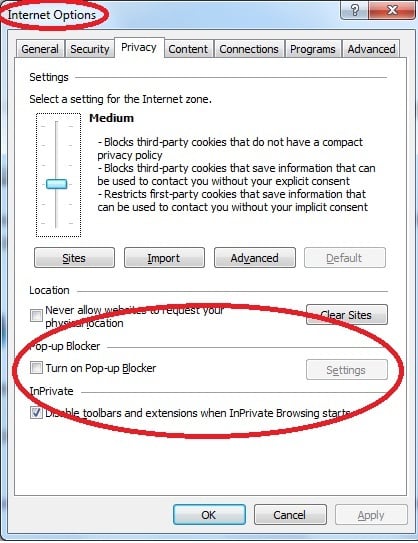

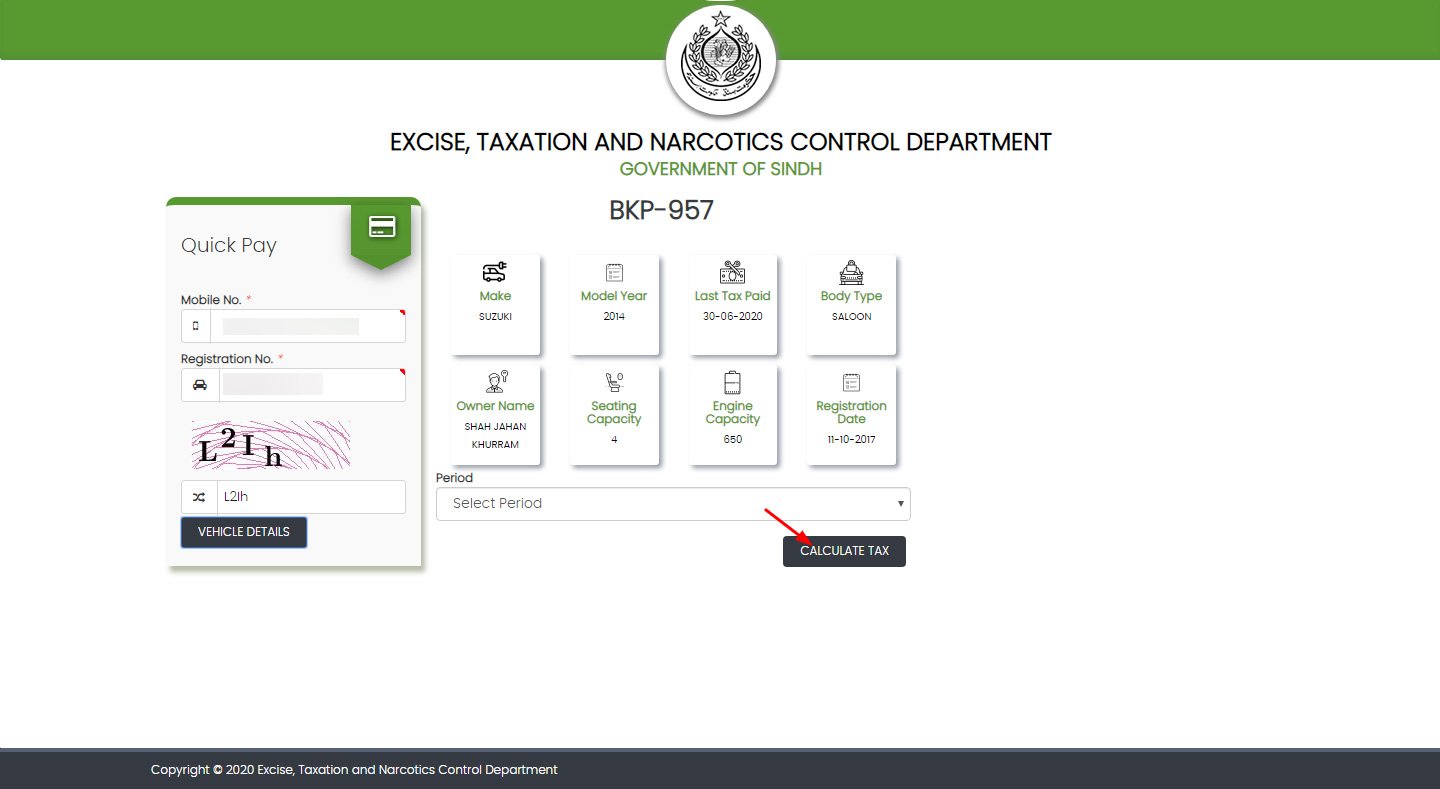

How To Pay Online Motor Vehicle Tax Token Tax In Sindh

Your obligation as a taxpayer will depend on your circumstances.

. 9 am4 pm Monday through Friday. All Massachusetts residents who own and register a motor vehicle must pay the motor vehicle excise annually. Pay personal income tax owed with your return.

If you have received a motor vehicle excise tax bill payments are overdue. Payment at this point must be made through our Deputy Collector Kelley. Payment by credit card or electronic check may be made online through Invoice Cloud.

Residents who own motor vehicles have to pay taxes based on the value of their vehicles each year. Taxes and Filing. Sequentially number your excise tax returns for the entire calendar year and start your serial numbers over at 01 at the beginning of each calendar year.

Once you enter your NAME please CLICK one of the options below to continue entering specific information. A motor vehicle excise is due 30 days from the day its issued. As a TTB-regulated industry member you may be responsible for paying federal excise taxes.

Paying sales and use tax. Hawaii General Excise Tax Form G-45 is the periodic form that must be filed at intervals throughout the year. Majority of bills are due in late March or early April.

You can pay or schedule a payment for any. Section 70 1 late fee for delay in filing the return. Sales tax is paid directly to the retailer where items are purchased.

You will not be cleared out of the RMV for non renewal until all past due taxes are paid on all outstanding plates. Use tax is reported and paid to the Department of Revenue with a regular excise tax return. Excise Tax on Coal.

Not just mailed postmarked on or before the due date. Tax information for income tax purposes must be requested in writing. Get your bill in the mail before submitting online.

How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. Motor Vehicle Excise Tax bills are issued each calendar year to. Pay by pre-authorized debit You can set up a pre-authorized debit.

You can make a payment with your Visa Debit or Interac Online debit card through the My Payment service. If an excise is not paid within 30 days from the issue date the local tax collector will send a demand with a fee of not more than 30 dollars. Overview If you would like to pay your Real EstatePersonal Property Motor Vehicle and Boat Excise Taxes or Water Bills online just follow these simple instructions.

Internal Revenue Code 4121 imposes an excise tax on coal from mines located in the United States sold by the producer. Payment by credit card or electronic check may be made over the phone by. Pay income tax through Online Services regardless of how you file your return.

Pay Delinquent Excise. The tax collector must have received the payment. The excise tax is deposited in the Black Lung.

The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on Imports For Resale and 4 for. An additional fee will be added to your account if not paid by Thursday. Once completed click the NEXT button within the option you choose.

Thirty days after issue date varies upon registration of vehicle. Contact Us Your one-stop connection. You must file an excise tax return.

The city or town where the vehicle is principally garaged. How to Make a Payment.

New Gst Registration Procedure Gst Number Blog Tools Registration Confirmation Letter

Atd And 116 Industry Stakeholders Call For Suspension Of Federal Excise Tax Fet On Heavy Duty Trucks And Trailers Heavy Duty Trucks Truck And Trailer Trucks

How To Pay Online Motor Vehicle Tax Token Tax In Sindh

What Is Transmittal Form 1096 Irs Forms Irs Tax Forms

How To Pay Vehicle Token Tax Online Using E Pay Punjab App Youtube

How To Pay Online Motor Vehicle Tax Token Tax In Sindh

Federal Excisetax Form2290 Quarterly Federal Excise Tax Form720 International Fueltax Agreement Report Ifta All These Tax Deadline Filing Taxes Tax

Digital Tax Stamp Businesses Must Comply With New Excise Tax Norm Digital Tax Consulting Business Chartered Accountant

Excise Tax Return Filing And Payment Zoho Books

How To Pay Online Motor Vehicle Tax Token Tax In Sindh

Online Bill Payment Town Of Dartmouth Ma

Accounting Taxation Service Tax Taxable Services Abatement Value Taxable Value Effective Rate New Service Tax Income Tax Return Service Tax

Online Bill Payments City Of Revere Massachusetts

Gst Migration Registration For Existing Assessee Internal Audit Consent Letter Patent Registration

Penalty For Late Filing Irs 1099 Information Return Irs Forms 1099 Tax Form Irs

How To Pay Online Motor Vehicle Tax Token Tax In Sindh

Get Your Business Registered Under Gst With Businesscrow Legal Services Registration Indirect Tax

Corporate Excise Tax Penalties Waived S Corporation Efile Irs